Inventory protection should be top of mind for merchants of all sizes. Learn how to protect your most valuable yet most vulnerable asset no matter where it is on its journey to your end customer.

Inventory Protection: Fix What You Can Control — Plan for What You Can’t

Your Greatest Investment

According to the National Retail Federation, inventory shrink is 1.38% of overall sales, and 11% of retailers have shrink rates of 3% or higher. While traditionally the greatest area of focus for reducing inventory shrink has been in-store loss prevention, the NRF report shows that shoplifting only accounted for 37.5% of shrinkage. This means retailers are losing the remainder of their inventory to preventable administrative errors, damages, and obsolescence.

As a small to mid-sized merchant, your inventory is likely your largest asset. Having so much of your valuable capital invested in this single area of your business may feel like a vulnerable situation for many merchants, but there are steps businesses of all sizes can take to protect inventory against damage or loss at every stage from procurement to final mile.

Your Most Vulnerable Asset

Inventory has a long journey to your end customer — most of which you don’t see. Any kind of loss or damage can occur in transit from your supplier to your warehouse, during inbounding or storage, while being picked and packed, in transit to your customer, or on your customer’s front porch. Each phase of your inventory’s journey opens you up to potential revenue loss, and no matter how an item is damaged, it’s the reputation of your business that is ultimately at stake.

The added cost of returns can also begin to eat into margins, particularly for ecommerce sales. On average, consumers return online orders at a rate of 20%, and in a recent survey by Ware2Go, 29% of respondents reported that they had returned an item because it arrived damaged.

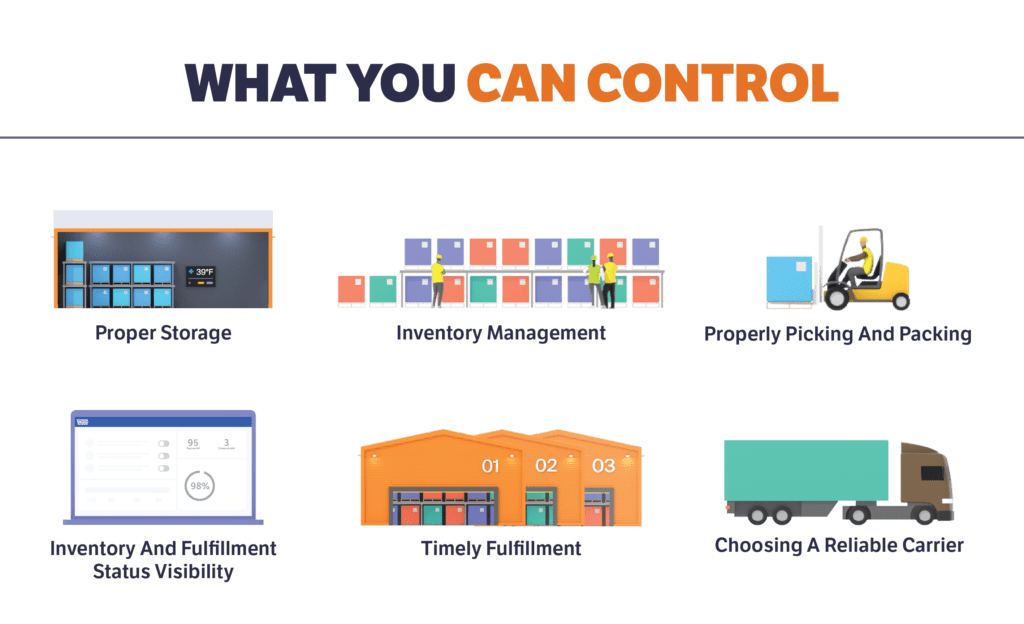

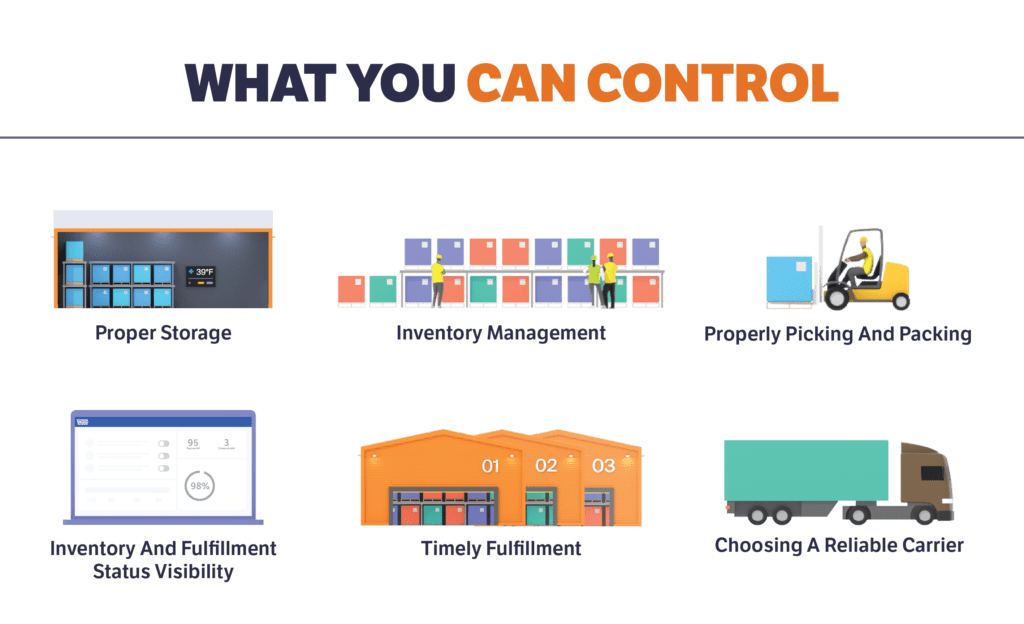

Inventory Protection: What You Can Control

Fortunately, many of the points of vulnerability in your inventory’s journey may not be visible to you but can be closely monitored and controlled. The key may lie with your outsourced fulfillment provider. Fulfillment technology is quickly evolving, giving you full visibility into your inventory levels and fulfillment and delivery statuses. Finding a trusted logistics partner will help protect your inventory in the following ways:

- Sku-level management of your SOP’s:

- Proper storage: Do you know that the warehouse is properly labeling and storing your inventory to ensure all items are properly accounted for? Are all of your product’s humidity and temperature requirements being adhered to?

- Proper inventory management: Do you know that the warehouse is following your preferred method? Whether your products are perishable or not, most inventory has a shelf life, and a trusted warehouse partner will follow your FIFO or LIFO inventory management system to avoid revenue loss through obsolescence.

- Properly picking and packing: Can you trust your warehouse partner to pick and pack orders according to your specifications to ensure items aren’t damaged in transit?

- Inventory and status visibility: Does your fulfillment partner employ technology that allows for near-time monitoring of inventory and fulfillment statuses? Can you easily set SOP’s and storage requirements for new products through their online platform?

- Timely fulfillment: Do you have a fulfillment partner that guarantees same-day fulfillment and on-time delivery? Ware2Go’s consumer survey revealed that 33% of consumers returned items because it had taken too long to deliver them. Today’s customer expects affordable 1 to 2-day delivery. Do you have a partner with an extensive warehouse network to position your inventory close enough to your customers for 1 to 2-day ground delivery?

- Reliable Carrier: Choosing a trusted carrier instills a sense of confidence in your customers and decreases the likelihood of a lost, damaged, or late package. UPS, for example, managed to consistently keep its on-time delivery rates significantly higher than even its largest competitors at a time when all carriers struggled to keep up with record ecommerce demand.

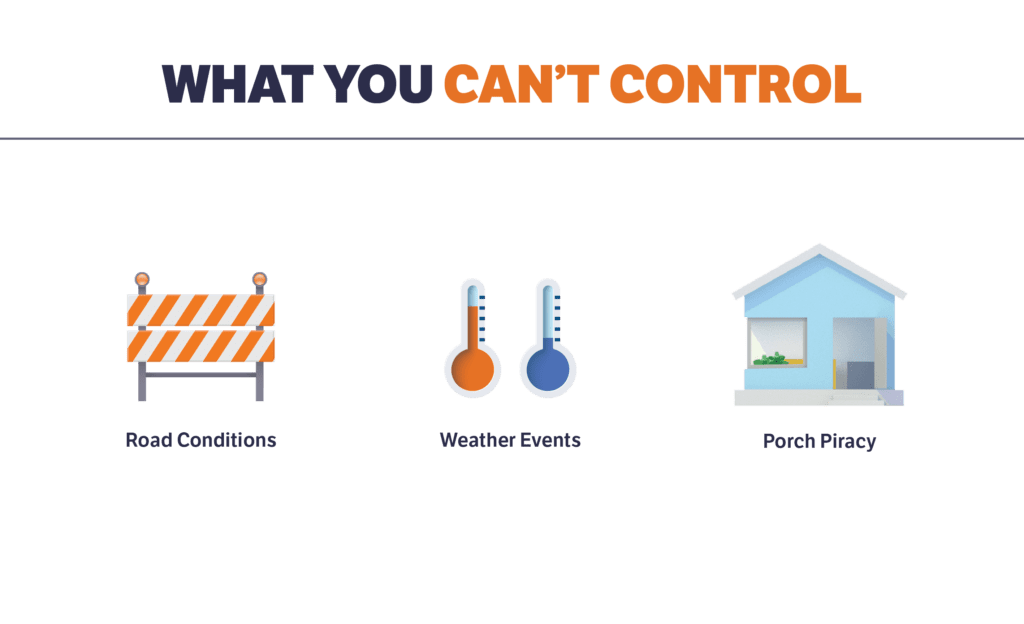

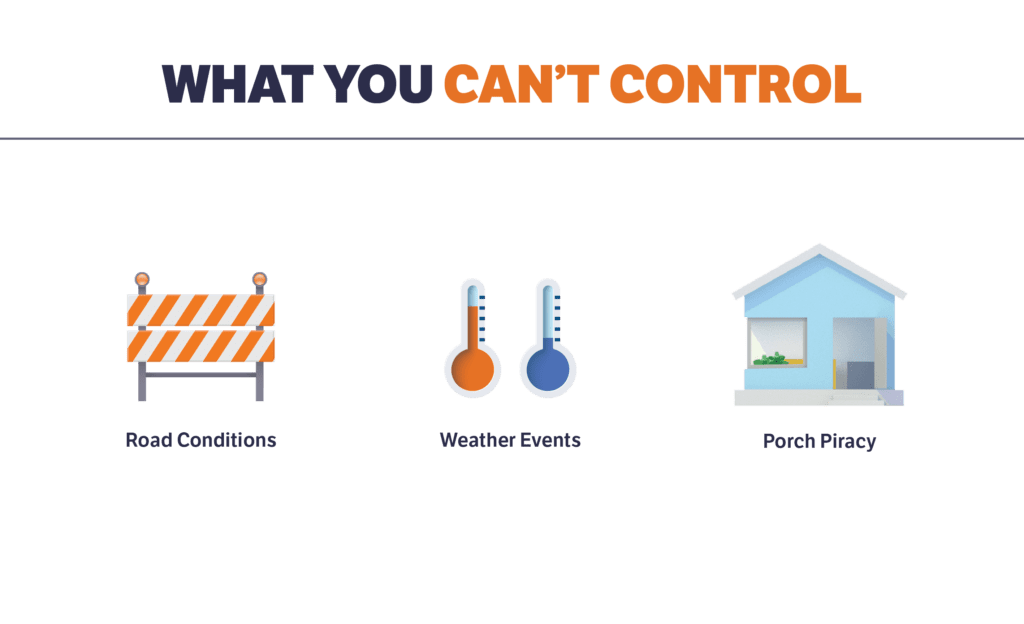

Inventory Protection: What You Can’t Control

Choosing a trusted fulfillment provider helps you gain control over your inventory in the warehouse, but on your inventory’s journey from the warehouse to your end customer, there are a number of factors that can compromise the safety. According to a recent Harris poll, 1 in 10 shipments has a glitch resulting in loss, damage, or delay. Depending on mode, these glitches can affect 10-15% of merchants’ shipments each year. These glitches can be caused by a number of factors:

- Road Conditions: Vehicle collisions or bad road conditions can damage packages, even with the most careful driver.

- Weather events: You will have no control over temperature or overly wet or dry weather when your inventory is in transit. Once the package has been delivered, there’s no guarantee that your customer will have a protected area to leave packages in the rain or snow.

- Porch piracy: As many as 36% of Americans have had an unattended package stolen, and the growing prevalence of doorbell video monitoring has had little to no effect.

As a business owner, these factors are completely out of your control but could ultimately lose your business money and brand equity. For these instances that are outside of your control, a full coverage insurance plan is the best measure to protect your revenue and the reputation of your business.

Confident Customer Service

A comprehensive insurance plan not only gives you peace of mind, but enables you to respond quickly in the event of a shipping glitch resulting in loss or damage. Having confidence that your coverage will protect you against any loss or damage allows you to immediately rectify a customer experience, whether through refund or a replacement item, without worrying how it will affect your bottom line.

Most carriers offer standard coverage called carrier liability. This type of coverage requires the shipper to prove the carrier was at fault for the loss or damage, and recouping lost value can be a time-consuming process. UPS Capital Insurance Agency, Inc. (“UPS Capital”) offers true insurance via transactional policies that allow businesses to pay only for what they need. These policies extend coverage to goods while they are in transit and warehoused — regardless of the mode or carrier they are moved or housed by — and claims are paid quickly, regardless of fault.

UPS Capital offers coverage up to the full retail value of goods where 99% of claims are paid, and most of them in 4 days or less. This gives you full confidence that, in the event of loss or damage, you can replace the item with no loss of revenue, and by resolving the issue quickly can rectify potentially soured customer relationships.

Strategic Partnerships for End-to-End Inventory Protection

UPS Capital’s relationship with trusted fulfillment partners like Ware2Go means that you have truly end-to-end protection built into your supply chain. Ware2Go’s highly vetted network of warehouse partners and best-in-class fulfillment technology ensure protection against the factors you can control, from mis-picks to inventory shrinkage. UPS Capital’s transactional insurance protects against all the factors you can’t control while your inventory is in transit or on your customer’s front porch.

Insurance is underwritten by an authorized insurance company and issued through licensed insurance producers affiliated with UPS Capital Insurance Agency, Inc. and other affiliated insurance agencies. UPS Capital Insurance Agency, Inc. and its licensed affiliates are wholly owned subsidiaries of UPS Capital Corporation. The insurance company, UPS Capital Insurance Agency, Inc. and its licensed affiliates reserve the right to change or cancel the insurance coverage at any time. The insurance is governed by the terms, conditions, limitations and exclusions set forth in the applicable insurance policy and no warranty, guarantee, or representation, either express or implied, is made as to the correctness or sufficiency of any information contained herein. Insurance coverage is not available in all jurisdictions.